Bond rate of return formula

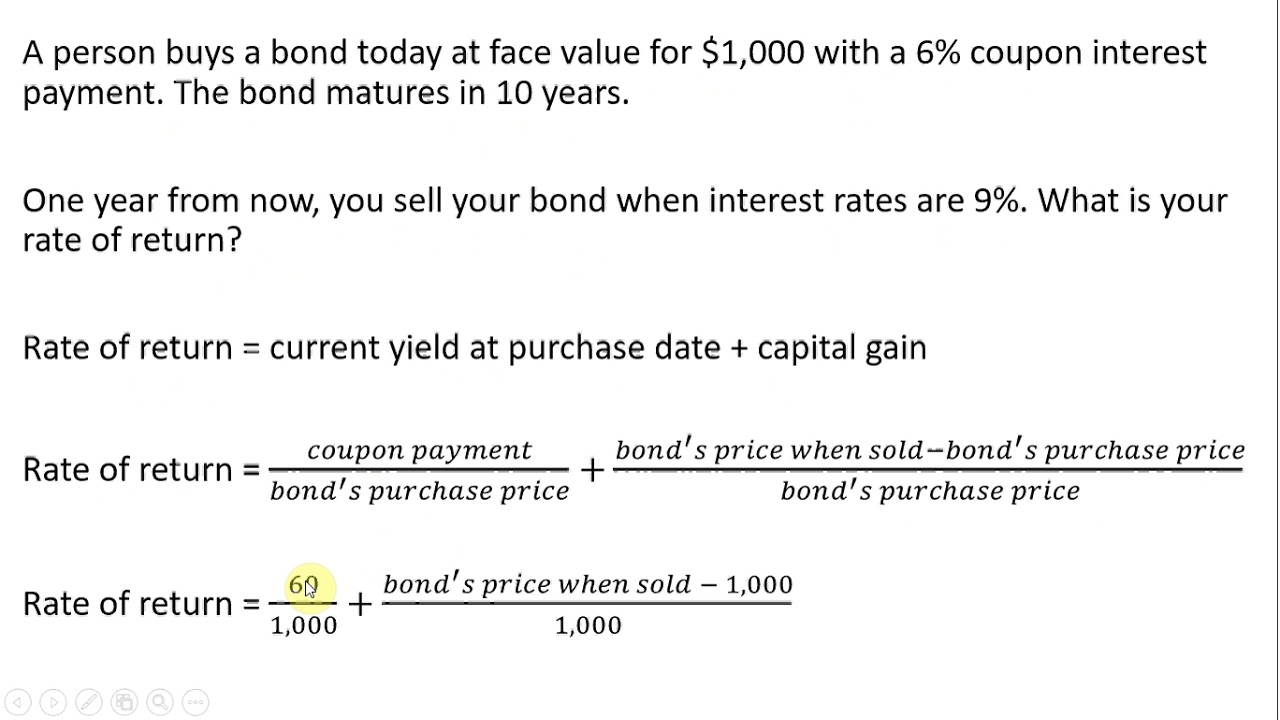

To calculate the annual rate of return on a bond divide the bonds interest earned and price appreciation by the bonds value at the beginning of the year. Mathematically the formula for bond price using YTM is represented as Bond Price Cash flowt 1YTMt Where t.

Coupon Bond Formula How To Calculate The Price Of Coupon Bond

Sign Up and Learn How to Diversify.

. On the other hand the term current yield. Annual Rate of Return End of year price Beginning of year price Beginning of year price x 100 For example if an investment is worth 70 at the end of the year and was. 250 20 200 200 x 100 35 Therefore Adam.

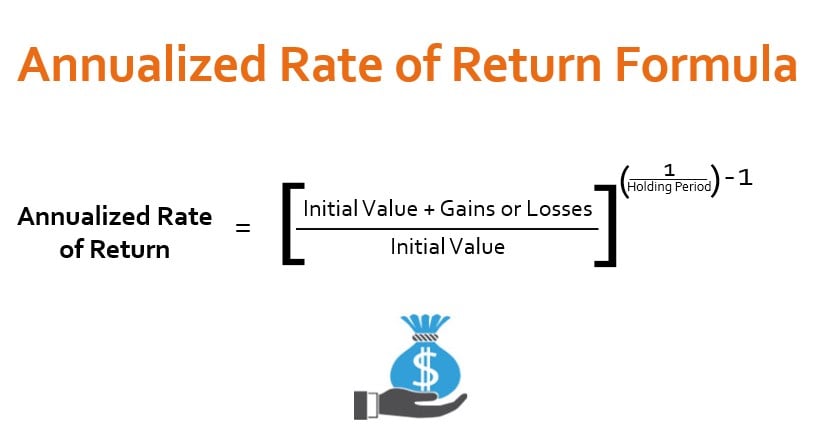

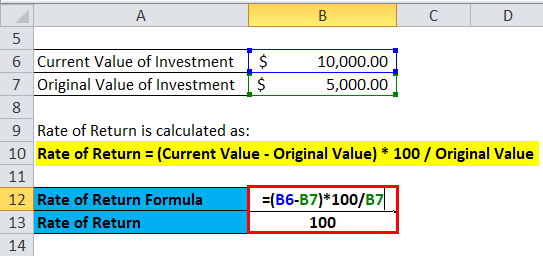

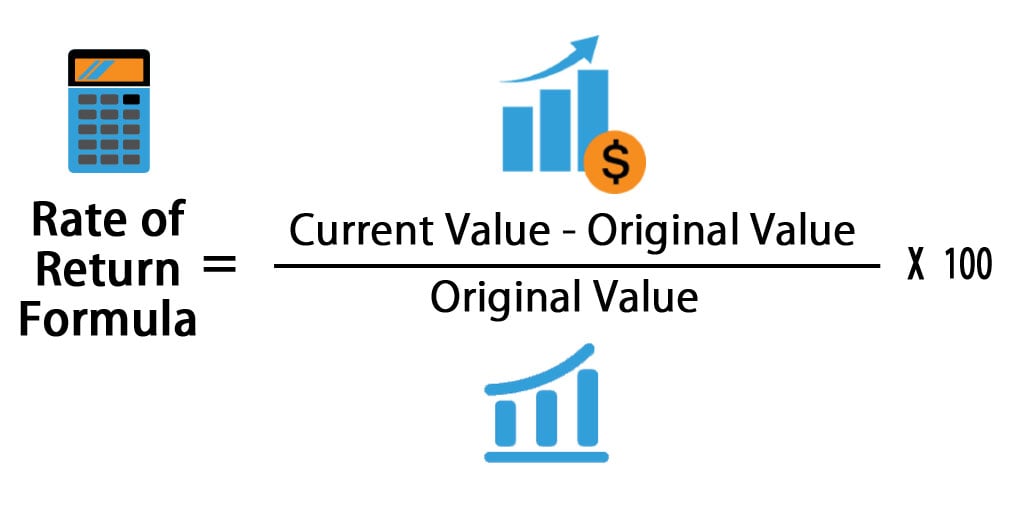

Required Rate of Return formula Expected dividend payment Stock price Forecasted dividend growth rate The required return equation utilizes the risk-free rate of return and the market rate. CFX 1 IRRX Using the above examples. Rate of return Current value of investment Initial value of investment Initial investment value 100.

The formula for rate of return is as follows. 10 shares x 20 200 Cost of purchasing 10 shares Plug all the numbers into the rate of return formula. If youve held a bond over a long period of time you might want to calculate its annual percent return or the percent return divided by the number of years youve held the.

To determine the current yield you need to divide the amount of the coupon rate by the price the bond is currently selling for. Composite rate fixed rate 2 x semiannual inflation rate fixed rate x semiannual inflation rate 00000 2 x 00481 00000 x 00481 Composite rate. The bond yield can be seen as the internal rate of return of the bond investment if the investor holds it until it matures and reinvesting the coupons at.

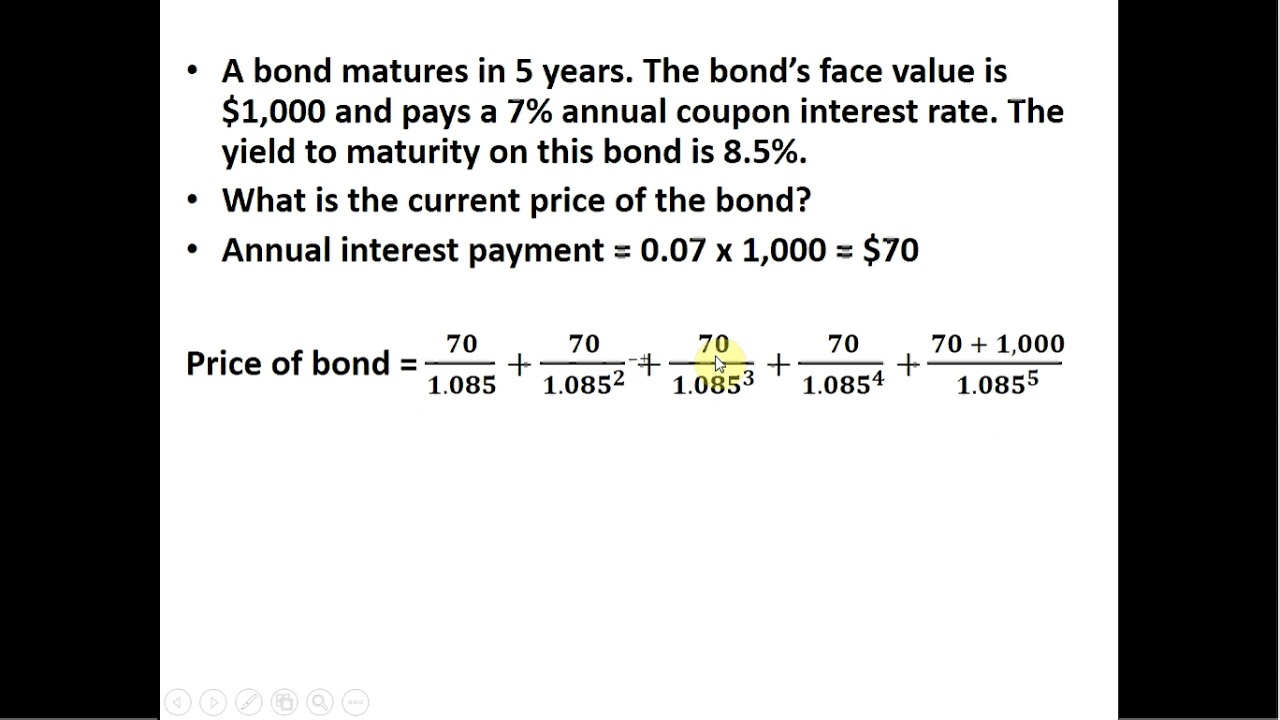

Calculating the Expected Return The expected return on a bond can be expressed with this formula. Bond Pricing Formula How. Price of bond is calculated using the formula given below Bond Price Cn 1YTMn P 1in Bond Price 60 11 60 11 2 60 11 3 60 11 4 60 11 5 60.

RET e F-PP Where RET e is the expected rate of return F the bonds. Current Yield Formula. Ad Three Reasons to Choose Fixed Income.

Begin aligned text wacc w_d k_d 1 - t w_ ps k_ ps w_ ce k_ ce textbf where text wacc text weighted average cost of capital text. IRR internal rate of return t period from 0 to last period -or- 0 initial outlay 1 CF1 1 IRR1 CF2 1 IRR2. For the coupon amount you would.

Of Years to Maturity.

Bond Yield Formula And Calculator Excel Template

Discounted Dividend Model Ddm Dividend Financial Management Model Theory

Yield To Maturity Ytm Formula And Calculator

Gordon Growth Model Valuing Stocks Based On Constant Dividend Growth Rate Dividend Power Dividend Dividend Investing Value Investing

How To Calculate The Current Price Of A Bond Youtube

Rate Of Return Formula What Is Rate Of Return Formula Examples

Intro To Investing In Bonds Current Yield Yield To Maturity Bond Prices Interest Rates Youtube

How To Calculate The Rate Of Return On A Coupon Bond Youtube

Bond Yield Formula Calculator Example With Excel Template

Annualized Rate Of Return Formula Calculator Example Excel Template

How To Calculate The Rate Of Return On A Coupon Bond Youtube

Rate Of Return Formula Calculator Excel Template

/dotdash_Final_How_Are_Bond_Yields_Affected_by_Monetary_Policy_Nov_2020-01-9f04bd0397654170a7975ba70dc403a9.jpg)

How Are Bond Yields Affected By Monetary Policy

How To Calculate The Yield Of A Zero Coupon Bond Using Forward Rates Bond Calculator Really Cool Stuff

Real Rate Of Return Formula And Calculator

Bond Pricing Formula How To Calculate Bond Price Examples

Rate Of Return Formula Calculator Excel Template